The next frontier of asset valuation

Recognise the lack of price signals and transaction histories.

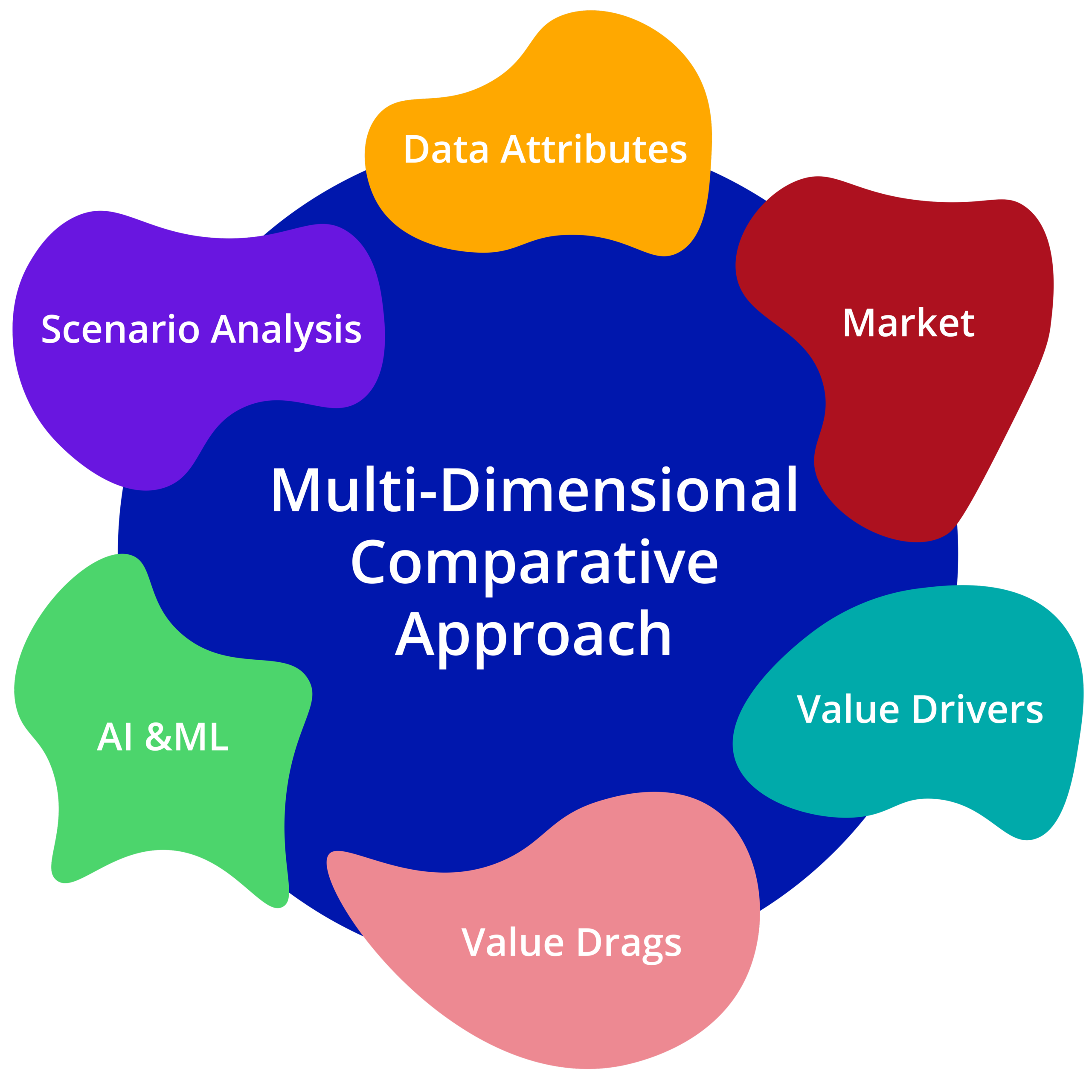

Use a valuation methodology that accommodates the variance of core attributes.

Use data science, AI and ML techniques to create a bespoke approach.

Our approach recognises that data is different. Aurum Data’s extensive R&D has blended traditional asset valuation methodologies with data science, AI and ML techniques to create valuation solutions that are practical and market-based.

Data assets have unique characteristics that diminish the effectiveness of traditional valuation methodologies.

The absence of price signals and transparent transaction histories limit the relevance of many asset valuation techniques.

The variance of core attributes prevents commoditisation and limits the fungibility of data assets.

Reporting around development and servicing costs is typically limited and there is significant subjectivity around utility.

More generally, data assets are not separately identified in accounting records.

The current lack of specific accounting principles creates challenges for companies and organisations seeking to create more transparency and accountability around their data assets.

While accounting standards may be contemporised in the future, many data asset holders are not waiting to get greater clarity on what their data is worth.

To address this growing need, Aurum Data spent several years in R&D, seeking to blend traditional asset valuation methodologies with data science, AI and ML techniques to create a bespoke valuation methodology for data assets that is now available to the holders of data assets.